Today, GE Aerospace (GE, Financial) experienced a daily loss of 2.37%, yet it has gained an impressive 41.35% over the past three months. With an Earnings Per Share (EPS) of 3.05, investors are prompted to question: is the stock significantly overvalued? This analysis aims to explore GE Aerospace's valuation extensively, encouraging readers to delve deep into our financial examination.

Company Introduction

GE Aerospace, a leader in the aerospace sector, designs, manufactures, and services large aircraft engines. It boasts a global installed base of nearly 70,000 commercial and military engines, primarily earning through recurring service revenues. As the core business of the original conglomerate founded in 1892, GE Aerospace has spun off various businesses over the years, focusing intensely on aerospace technologies. Currently, with a stock price of $159.5, which starkly contrasts the GF Value of $70.71, GE Aerospace appears significantly overvalued. This valuation discrepancy sets the stage for a deeper financial analysis.

Understanding the GF Value

The GF Value is a proprietary measure indicating the intrinsic value of a stock, based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. For GE Aerospace, the GF Value suggests a fair trading value significantly lower than its current market price. This discrepancy indicates that GE Aerospace is potentially overvalued, suggesting that the stock's future return might be lower than its business growth.

Financial Strength and Stability

Before investing, assessing a company's financial strength is crucial. GE Aerospace has a cash-to-debt ratio of 1.08, which is moderately positioned within the industry. This ratio, along with a fair financial strength rating of 6 out of 10, suggests that GE Aerospace maintains a reasonable balance between its cash reserves and debt levels.

Profitability and Growth Insights

Profitability is a less risky indicator to consider before investing. GE Aerospace, with an operating margin of 5.9%, indicates a profitability that is below average in its sector. Furthermore, the company's growth metrics such as a 3-year average annual revenue growth rate of -3.7% suggest challenges in maintaining a competitive edge and expanding its market share.

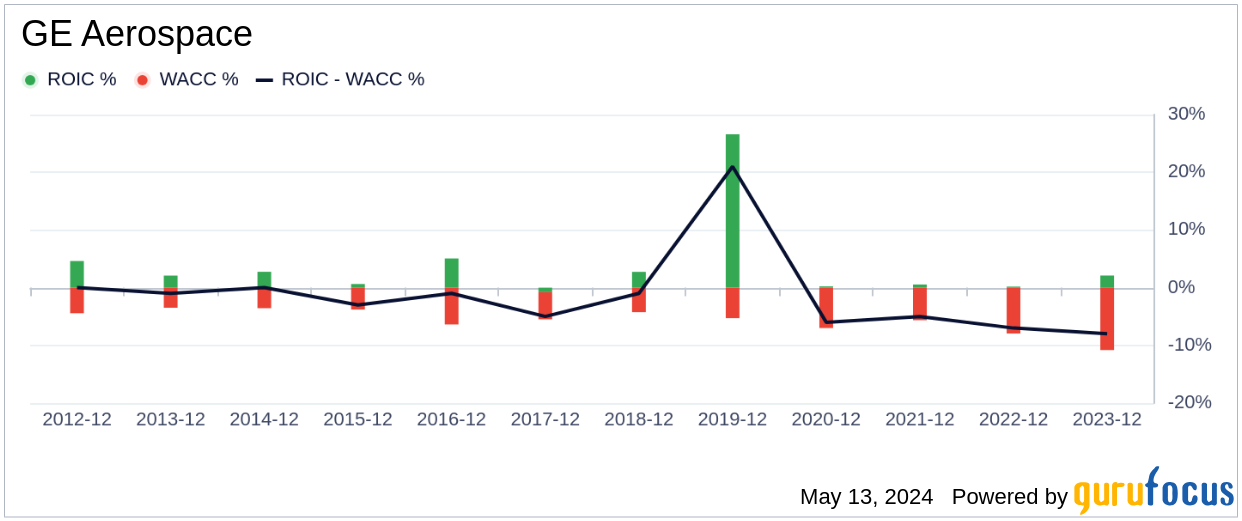

Evaluating Investment Returns: ROIC vs WACC

Comparing Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC) provides insights into value creation. GE Aerospace's ROIC of 2.35 is substantially lower than its WACC of 12, indicating that the company is not generating sufficient returns on its investments.

Conclusion

In summary, GE Aerospace (GE, Financial) appears significantly overvalued based on its current market metrics and financial analyses. The company's moderate financial health and below-average profitability, compounded by inadequate growth rates, suggest cautious consideration for potential investors. For a more detailed financial overview, interested parties can view GE Aerospace's 30-Year Financials.

To discover high-quality companies that may deliver above-average returns at reduced risk, consider exploring the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.